Sba commercial loan calculator

Has a 20-year maturity rate for real estate and land. More info on SBA loans.

A Breakdown Of The 7 A Loan Program For Small Businesses

How Does the SBA 7a Loan Differ from the SBA 504 Loan.

. This page includes the details of the SBA 7a loan terms and rates as well as specifics about loan amounts and maturity ratesAlso if youre making an SBA loan checklist you might. Youll commonly see commercial loan terms from 5 to 20 years. Fast and easy set up.

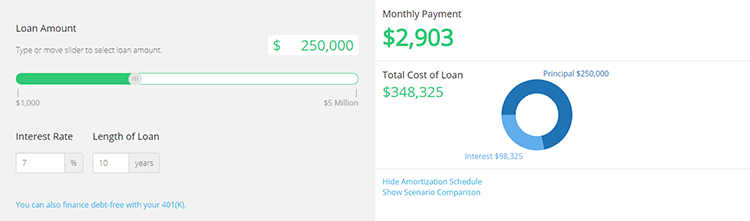

Because interest rates and terms can vary depending on whether the property is an investment property or owner-occupied we have a commercial mortgage calculator for each scenario to give you the most accurate estimates. Loan Payment Calculator. The interest rate on an SBA 7a loan is pegged to a base rateprime LIBOR or an optional peg rateplus 225 to 475 depending on the loan amount and term.

SBA 7a Loan Calculator. If you want a basic working capital loan and youre not in a hurry for example youll probably just want to stick to an SBA 7a loan. The borrower will be eligible for a 025 percentage point interest rate reduction on their loan if the borrower or their cosigner if applicable has a qualifying account in existence with us at the time the borrower and their cosigner if applicable have submitted a completed application authorizing us to review their.

Thats why we created our business loan calculator. Borrowers who need copies of their loan documents. SBA 504 Loan Rates.

This tool figures payments on a commercial property offering payment amounts for P I Interest-Only and Balloon repayments along with providing a monthly amortization schedule. While a loan request letter may be needed for bank and SBA loans it wont be enough for approval unless its supported by a sound credit situation and solid financial planningFor your request to be persuasive to lenders you should do 2 things before preparing your business request letter and loan application package. If you have an SBA 7a loan offer use the SBA loan calculator below to get estimates on everything you need to know to make an informed.

Host Main Indexes on Your Site Features. An SBA 504 loanor CDC504 loanis a financing program the SBA offers to promote business growth and job creation through the purchase or improvement of real estate equipment and other fixed. 2022 SBA is no longer processing COVID-19 EIDL loan increase requests or requests for reconsideration of previously declined loan applications.

Restaurant franchise owners SBA 7a loans up to 5000000 with terms up to 25 years are available to start buy or expand your restaurant franchise business. And if youre planning an intensive real estate project you may want an SBA 504 loan. Prerequisites for Writing Loan Request Letters.

To see the total interest charged over time for any type of commercial loan visit our calculator on this page and look at the Total Interest under the Payment Summary chart after inputting your. Is a larger loan with a minimum of 125000 and a maximum of 20 million. Funds can be used to cover working capital equipment purchases and.

Youll get help with the lending process faster decision times and quicker access to your loan funds when working with TD Bank a Preferred SBA Lender. Has a fixed interest rate. If you need less money but you need it fast an SBA Express loan might be more your speed.

Covid19relief1sbagov also known as the RAPID portal is closed. Another option for real estate and land loans is the SBA 504 loan program. Todays commercial loan rates can average between 450 and 1629 depending on the loan product.

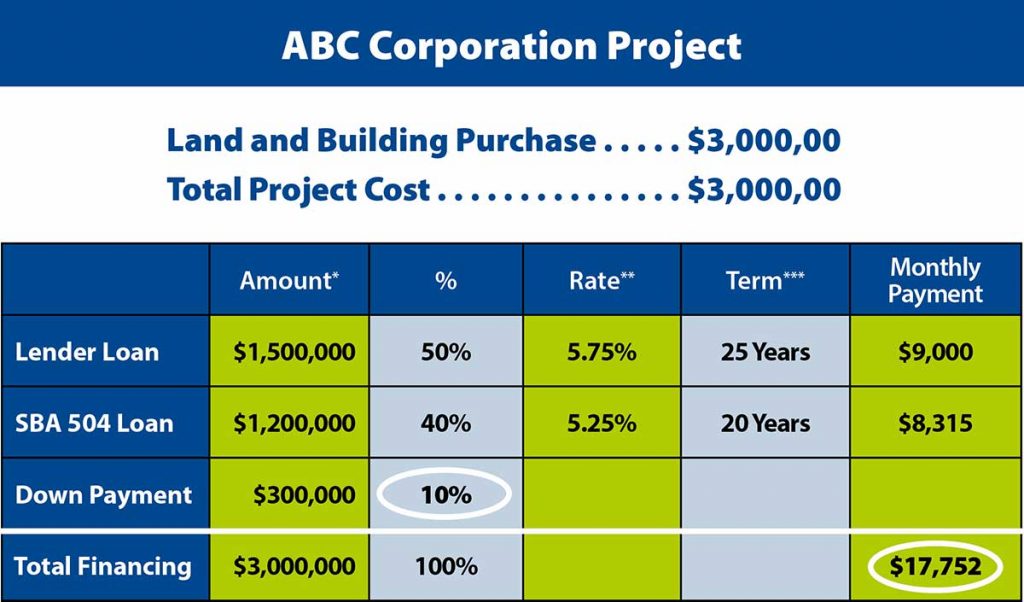

If you need to calculate payments for an SBA 504 loan many community development corporations can provide those calculations for you. As part of our commitment to the growth of small businesses nationwide US. Compared to the SBA 7a loan the SBA 504 loan.

A small business loan like the SBA 7a loan can be exactly the nudge you need to grow your organization -- but no matter how you spin it borrowing for your business is a big decision. Bank is proud to be an SBA Preferred Lender specializing in providing Small Business Administration SBA loans. In accordance with SBAs recently issued guidance SBA advises all procurement professionals not to use NAICS 2022 codes when preparing solicitations and awarding contracts until SBA updates its small business size standards to NAICS 2022 which SBA anticipates implementing on October 1 2022.

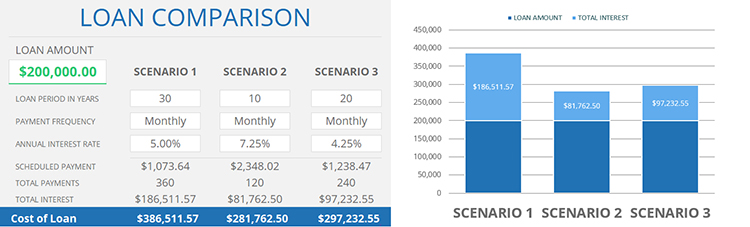

Loan amount interest rate loan term and collateral affect your monthly mortgage payment and the total cost of the loan. The interest paid on a commercial real estate loan will depend on the interest rate charged the length of the term and the amortization schedule. A loan with a Small Business Administration guarantee will require many documents for the SBA and the lender to gauge your lending risk.

When your small business is looking to grow or expand SBA loans can have many benefits. Until SBA updates its size standards the NAICS. Keep in mind that commercial loan term lengths can vary a lot depending on what kind of real estate youre buying with your mortgage loan.

Calculator Rates Commercial Property Loan Calculator. When credit card and student loan payments eat up most of. The SBA 7a loan might be right for your business so we want to make sure you have all of the information you need to make a decision.

Of course you can always use a loan calculator to see exactly how term length affects the overall cost of your small-business loan. The interest rate will tell you a lot but to fully understand the cost of an SBA loan youll need to have more information including the APR and the total cost of borrowing. This calculator does not assure the availability of or your eligibility for any specific product offered by Citizens or its affiliates nor does the calculator predict or guarantee the actual rate.

Please dont use this calculator for calculating interest rates or payments on SBA 504 loansThe SBA 504 loan consists of two separate loans and our calculator isnt set up to accurately calculate this loan product. Enter different loan amounts interest rates and terms in years to get a clearer picture of how much youll actually have to pay. View todays average commercial loan rates.

On the other hand you. These loans require only a 10 percent down payment by the small business owner and funding amounts range from 125000 to 20 million. Results provided by this calculator are intended for Illustrative purposes only and the accuracy is not guaranteed.

SBA 7a Loan Calculator. Small Business Administration SBA Loans Trust your business to a Preferred SBA Lender. Each lender sets rules within the SBAs guidelines but a.

With an SBA 504 loan you can obtain up to f 55 million from your CDC lender. This savings goal calculator will help you determine how much youll need to save each month in order to realize your next big purchase. An SBA 504 loan is commercial real estate financing for owner-occupied properties.

How to build an emergency fund when you have debt. Business Commercial Loans Agricultural Loans Commercial Real Estate SBA Loans Credit Cards. The SBA 7a program offers several loan options ranging up to 5 million with terms that extend to 25 years.

Your actual results may vary. Go to Next Section. SBA 7a Loan Amounts Maturity Interest Rates and Fees.

SBA 7a Rates.

2

Small Business Loan Calculator Td Bank

Commercial Loan Calculators Monthly Payment Refinance Dscr Cap Rate Noi Calculators

Sample Project Statewide Cdc

Business Loan Rates In 2021 Sba Loans And More Finder Com

Business Loan Calculators Estimate Your Payments Lendio

Business Loan Calculator Find The Best Loan For Your Small Business

What Is The Difference Between The Sba 504 Loan And The Sba 7a Loan Dakota Business Lending

2

The Importance Of Business Financing Calculators When Buying A Business Guidant

Sba Loan Calculator Estimate Payments Lendingtree

.png)

Business Loan Calculator Find The Best Loan For Your Small Business

Monthly Business Loan Repayment Calculator Td Bank

What You Need To Know About An Sba Loan Ondeck

What Is A Business Loan Calculator And Is It Helpful Fora Financial Blog

The Importance Of Business Financing Calculators When Buying A Business Guidant

Business Loan Calculator Small Business Trends